The insurance application (which we really don't recommend). What actions can cancel your personal auto policy?Īlthough not every reason to get a commercial auto policy is the result of an coverage issue, you may not qualify for a personal auto policy without misrepresenting yourself on It covers operations outside of operating the vehicle. This is a huge reason why many contractors opt for a commercial auto policy. This means that if you are unloading your vehicle, your auto policy would cover any damage to property or injuries that occur prior to you placing that object down in its intended spot. The commercial auto insurance policy has coverage that expands the auto insurance to include loading and unloading activities. From the liability associated with operating your equipment to the physical damage of your expensive attachments, you are better protected under the commercial auto policy. Many customers have commercial equipment permanently installed on their vehicles, such as booms, lifts, cranes, welders, compressors, etc.īesides not being able to qualify for a personal auto policy, you may find that a commercial policy would cover your exposures better anyway. You Have Specialized Equipment Attached To The Vehicle If you are taking any work that requires you to submit a certificate of insurance with auto liability coverage, you will likely need a commercial auto insurance policy. If you have a personal auto policy, chances are, the underwriter will not only decline the request to add an additional insured, but they will cancel the policy due to commercial auto exposure, too. No matter the industry, customers need certificates of insurance that require their vendors or subcontractors to have certain auto limits and add them as an additional insured. You Need An Additional Insured Or Waiver Of Subrogation Additionally, a personal auto policy in your name will not cover assets the business owns. Most personal auto insurance underwriters will not accept submissions from vehicles owned by a business. They are designed to defend you, protect your personal assets, and prevent you and your family from experiencing financial harm. Personal auto policies are not designed to protect and defend corporations from auto lawsuits and settlements.

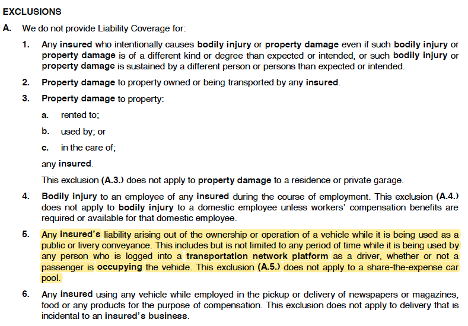

Having a vehicle titled in a business name is a sure sign that you need a commercial auto insurance policy. Public Or Livery Conveyance Use ExclusionĪs you can see, any delivery operations you might have are excluded even if your business isn’t delivering, per se, it is best not to leave it up to the claims adjuster to decide if delivery is "incidental to your business." A Business Owns The Vehicle There are two exclusions and limitations that could apply to your business: If you are making business deliveries in a vehicle and have a personal auto insurance policy, you are probably not covered for liability, physical damage, medical payments (personal injury protection in some states), or uninsured motorists.

.jpg)

If you do decide to go with a commercial auto policy or want to know more about which policy is right for you, check out our insight “ Personal Use Of Company Vehicles: What To Know.” When do you need a commercial policy? You Are Making Business Deliveries personal insurance is right for you, we explain why people choose commercial auto insurance and address exclusions that could apply to your business. To find out whether commercial insurance vs. The answer lies in certain coverage and vehicle use exclusions. With price being the obvious difference between the two, why would someone want to potentially pay more for a commercial auto policy?

While it is true that a commercial auto insurance policy is better equipped to deal with the claims that arise from commercial use of a vehicle, it is also more expensive. personal insurance, and what sort of policy they should go with. We frequently get calls from small business owners and independent contractors about commercial insurance vs.

0 kommentar(er)

0 kommentar(er)